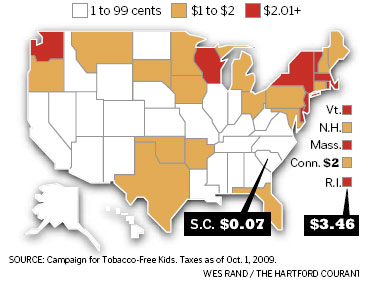

September 3, 2009 - On August 30th we reported August 30, 2009 that Republican Governor M. Jodi Rell and top Democrats still sharply disagree on many budget issues, but they have reached an accord on the cigarette tax: It needs to go up $1 a pack. (Connecticut - budget issues, governor and democrats agree on $1.00 cigarette tax increase..)

September 3, 2009 - On August 30th we reported August 30, 2009 that Republican Governor M. Jodi Rell and top Democrats still sharply disagree on many budget issues, but they have reached an accord on the cigarette tax: It needs to go up $1 a pack. (Connecticut - budget issues, governor and democrats agree on $1.00 cigarette tax increase..)The state legislature approved the tobacco tax increase this week and Governor Rell is allowing the budget to become law without her signature. (Governor Rell said Tuesday, September 1st, she will allow a $37.6 billion budget bill approved by the Democrat-led General Assembly to become law without her signature but will use her line-item veto to eliminate about $8 million in what she called pork projects. Wall Street Journal, 9/2/2009 - hard copy). The one-dollar increase in the cigarette tax was included in the budget that became law.

Beginning October 1, 2009 the cigarette tax will increase by $1 to $3.00 per pack.

From Matt Myers, Campaign for Tobacco Free Kids - Connecticut's leaders have taken action that will improve the health of Connecticut residents for generations to come and continue the state's leadership in the fight against tobacco use, the No. 1 cause of preventable death in the United States.

From Matt Myers, Campaign for Tobacco Free Kids - Connecticut's leaders have taken action that will improve the health of Connecticut residents for generations to come and continue the state's leadership in the fight against tobacco use, the No. 1 cause of preventable death in the United States.By failing to raise taxes on other tobacco products to match its new cigarette tax, Connecticut's legislators have chosen not to take advantage of a golden opportunity to raise a lot more money; money that could be used to increase funding for the state's tobacco prevention program and to help provide cessation assistance through the state's Medicaid program. Connecticut continues to be one of the last states to not provide any cessation coverage for its Medicaid recipients, and is still near the bottom of all the states with regard to tobacco prevention funding.

Pat Checko chairs the group Mobilizing Against Tobacco For Connecticut’s Health, also known as MATCH. She said Connecticut ranks at the bottom when it comes to states spending money on tobacco prevention. She said 21 percent of Connecticut high school students smoke – more than double the number of high school smokers in New York City.

Increasing the cigarette tax is one of the most effective ways to reduce smoking, especially among kids. Studies show that every 10 percent increase in the price of cigarettes reduces youth smoking by more than six percent and overall cigarette consumption by about 4 percent. Connecticut can expect the $1 cigarette tax increase to prevent 24,000 Connecticut kids from becoming addicted adult smokers; spur 10,000 current adult Connecticut smokers to quit for good; save more than 10,500 Connecticut residents from future smoking-caused deaths; lock in more than $520 million future health care savings; and raise about $60 million a year in new state revenue.

An action plan is needed to slow the sale of contraband (black market, bootleg, illegal, illicit) cigarettes avoiding the payment of taxes in the state where the tobacco is consumed.

Reference: Connecticut Cigarette Tax Increase Delivers Victory for Kids and Taxpayers; $1 Increase, Matthew L. Myers, President, Campaign for Tobacco-Free Kids - Reuters, 9/2/2009.

Conn. - the tax on a pack of cigarettes will be $3 a pack as of October 1, 2009..

No comments:

Post a Comment