January 27, 2010 - Shares of tobacco makers climbed Monday after Goldman Sachs analysts called for volume declines to slow dramatically in 2010 and economic stabilization to help cushion the companies from further margin losses. “We see improved volume performance emerging,” the analysts wrote in a note to investors. “We continue to believe the pricing environment will remain constructive.”

January 27, 2010 - Shares of tobacco makers climbed Monday after Goldman Sachs analysts called for volume declines to slow dramatically in 2010 and economic stabilization to help cushion the companies from further margin losses. “We see improved volume performance emerging,” the analysts wrote in a note to investors. “We continue to believe the pricing environment will remain constructive.”

It's interesting to note on the January 21st Credit Suisse - cut the U.S. tobacco sector but not Philip Morris International (PMI)..

As the economy crumbled in 2008 and 2009, smokers downgraded to cheaper regional cigarette brands from “premium” names, hurting tobacco makers’ margins. Goldman Sachs analysts said they don’t expect aggressive discounting or accelerating downtrading, especially as the job market improves.

Shares of Philip Morris International Inc. (PMI) its former parent company Altria Group Inc. and Lorillard Inc. all rose.

Meanwhile, the stocks also may have gotten a boost as the U.S. Supreme Court ruled Monday morning that New York City can’t use federal racketeering laws to force a cigarette seller to disclose its online client list in order for the city to collect taxes from customers.

It was initially unclear what effect the ruling would have on tobacco makers. Cigarette prices have increased dramatically over the past few years, mostly because of heavy taxes. New York City argued it was difficult to levy taxes on online cigarette sales.

Wall Street Access analyst David Silver said much of Monday’s gains are in response to the Goldman Sachs note. He said he believes 2010 is “going to be ‘less bad’” in terms of volume declines as the U.S. economy stabilizes. Though Europe and China are introducing new smoking bans and taxes, Silver said he isn’t worried that international volumes will suffer too much and actually sees significant growth opportunities in Latin America and Canada.

Reference: Tobacco Makers Up As Goldman Sees Volume Declines Easing by Melissa Korn of Dow Jones Newswires (melissa.korn@dowjones.com), The Wall Street Journal, 1/25/2010.

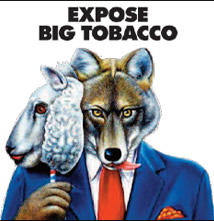

Bringing the World of Tobacco Control closer together..

Goldman Sachs analyst predicts cigarette volume declines to slow..

Subscribe to:

Post Comments (Atom)

To Provide Public Awareness

Purpose

About Us

Contact Us

2008 HIGHLIGHTS

TOPIX PAPERS - 2008 & 2009..

Archive

-

▼

2010 (1530)

-

▼

01/24 - 01/31 (35)

- Russia - Finance Ministry skeptical about raising...

- General Tobacco - will remove cigarette brands fro...

- Canada - U of A - tobacco researcher leaves school...

- Pakistan - over 273 people die daily of smoking re...

- European Union (EU) - “100 per cent smoke free en...

- Highlights - Altria - Q4 2009 Earnings Conference ...

- Scotland - parliament votes to ban retail cigarett...

- Bulgaria - leadership of tobacco fund to be replac...

- South Korea - KT&G forms alliance with Imperial To...

- NY State - Seneca Indians against U.S. Senator Gil...

- Florida - tobacco companies ask court to block ru...

- NYC Lawsuit against Online Cigarette Vendor Dismis...

- NY City - smokers kicking the addiction and living...

- NY City - gets tough with clubs that do not enforc...

- Menthol May Be Nicotine's Partner In Addiction..

- Manchester, England - supports bid to tax tobacc...

- Germany - losing billions as smokers find cheaper...

- Goldman Sachs analyst predicts cigarette volume ...

- A third of SIDs deaths could be avoided by quittin...

- Altria - to host webcast of 2009 fourth-quarter an...

- Singapore - illicit cigarette trade down by 37 per...

- Bulgaria - illegal trade in cigarettes will reach ...

- EU - mobilizing for a crackdown on cigarette smugg...

- Topeka, Kansas - opponents of smoking ban may drop...

- Lorillard - to release fourth quarter 2009 resul...

- OHIO - Legacy Foundation asks Supreme Court to hea...

- Philip Morris USA sued another New York retailer..

- South Africa - smoking rates remain high much more...

- Czech Republic - crackdown on tobacco use long way...

- January 25, 2010 -Tobacco display: the battle of t...

- Vancouver 2010 Winter Olympics - smoke-free with ...

- UAE - with new law e-cigarettes may face ban..

- UAE - preventing the sale of tobacco products to y...

- Australia Day - Tuesday, January 26, 2010..

- Russia reaches for full FCTC compliance..

-

▼

01/24 - 01/31 (35)

© Copyright Notice: The content of this website is for information education purposes only and any newsbrief may be used only as "fair use" for information/education purposes with permission of the authors and providing that original references and associated reference links are included in HTML format.

0 comments:

Post a Comment